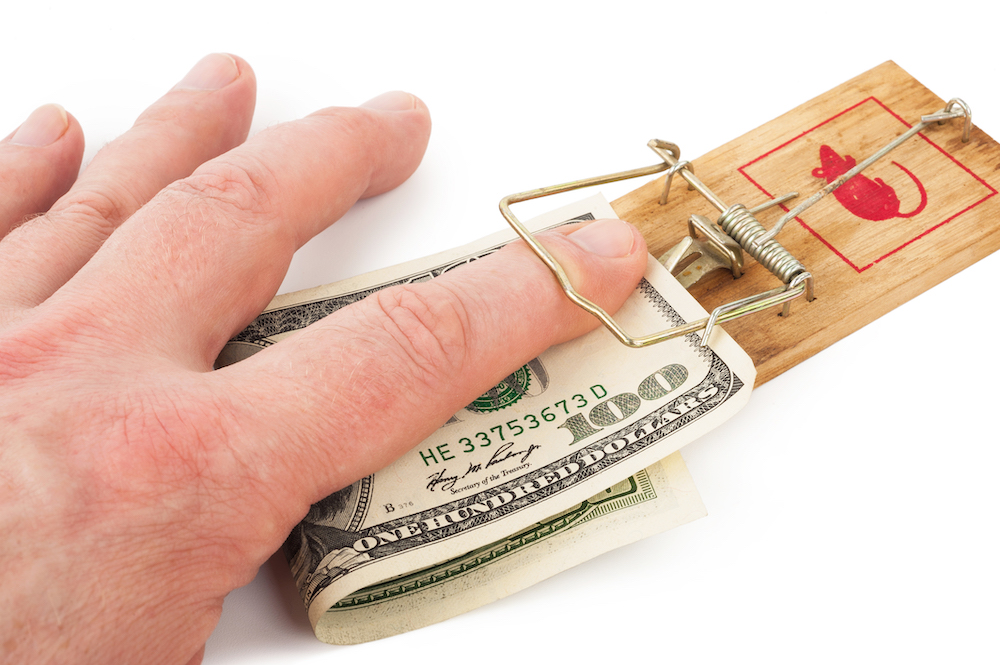

If you are in your 20's, you most likely have fallen into a money trap sometime in your life. Who doesn't make mistakes? We all desire to be financially stable and independent. However, we often find ourselves in a state of confusion and stress regarding money management. But we can all ensure not to fall into a money trap again if we are aware of our mistakes.

The Most Common Money Traps that People Fall into in Their 20s are:

- FINANCIAL IGNORANCE

Financial ignorance is the most significant reason that leads to a money trap among young adults. They are often not taught about financial literacy at school. The lack of financial education can lead to many disadvantages, such as no control over your debts, inability to manage your money, and inability to make financial decisions. Young adults who are financially ignorant have a higher chance of getting into debt because they are unaware of managing their money.

- LIVING WITHOUT A BUDGET

A budget is a plan of how you will spend your money. It's a way to control your finances. If you don't have a budget, it can be hard to gauge how much money you have coming in and going out each month. Living without proper budgeting can make bad financial decisions and lead to debt. In addition, it can cause some severe problems in the future- like not being able to afford rent or food! If you find yourself in this situation, it is time to take a step back and start budgeting.

- ACCUMULATING DEBT

Most people in their 20's are just starting to learn how to manage their finances. They might not have learned how to budget, or they might not have known about the importance of saving money. As a result, it is easy for them to get caught up in a money trap and accumulate debt. Some reasons are that they are just entering the workforce, have lower wages, and have more expenses. As a result, they often turn to credit cards to pay for emergencies and everyday living expenses. The disadvantage of accumulating debt is that it can be hard to get out of it.

- FAILURE TO SAVE FOR EMERGENCIES

Most young adults do not have an emergency fund. The lack of emergency funds can lead to more financial difficulties. Since most of them are not aware of handling emergencies, they take out high-interest loans or go into debt to finance these emergencies. In addition, most young adults might be tempted to spend their money on things like travel, clothes, restaurants, etc., but you need to remember that all these things add up, and you have no savings left before you know it. Therefore, having an emergency fund is vital.

- RECKLESS SPENDING HABITS

The '20s are a decade of exploration and experimentation. But uncontrolled experiments with finances can lead to reckless spending, which can be detrimental in the long run. There is also a higher chance of young adults spending on their wants instead of their needs without thinking. They tend to spend more than they earn, with no savings plan in place. This can lead to debit and credit card debt. It is essential to be cautious about spending recklessly, or it will lead to a "money trap" that you may not be able to get out of for many years.

Money traps affect people of all ages, but they are especially harmful to young adults as most of the time, people in their 20s are still at the beginning of their careers. Their credit score will affect their job prospects, ability to buy a house or car, and even their ability to rent an apartment. Young adults must understand how money traps can affect them and start doing something about it before it's too late. Above are some mistakes that you can avoid and not fall into a money trap.